Choice is beautiful, but it rarely comes without cost.

The future “multichain” promised was one where users and developers alike had the freedom to choose the best execution environment optimizing for trade offs such as speed, fees, decentralization and security. What we got instead was fragmentation – of liquidity, execution and ultimately, experience.

What was meant to empower both users and developers alike, has quietly shifted responsibility onto them. Simple actions now require navigating bridges, gas tokens, partial failures etc. The system didn’t just become more flexible, it became harder to use, and even harder to build on.

The evolution of traditional finance

It’s tempting to look at the current state of crypto and conclude that something has gone wrong, that a system meant to reshape finance somehow ended up worse than what it tried to replace. But what we see today in crypto is not unprecedented, but rather a replay of tradFi’s evolution compressed into decades rather than centuries.

Traditional banking went through similar phases:

- The era of private bank notes (analogous to native blockchain tokens): In the mid-1800s, there was no single “US Dollar.” Instead, thousands of private banks issued their own banknotes. If you had a note from a bank in Tennessee, a merchant in New York might only accept it at a 20% discount, or not at all. Value existed, but interoperability was poor.

- The era of physical porters and corresponding banking (analogous to bridges): Before modern clearing systems, banks settled obligations by physically transporting gold or cash between institutions — slow, risky, and inefficient. Over time, this evolved into correspondent banking, where one bank held accounts with another to facilitate transfers across regions and borders.

- The multi-rail explosion: By the mid-20th century, TradFi had too many rails: ACH (batch, slow), Wire transfers (fast, expensive), Checks, Regional settlement systems etc. With each rail having different guarantees, fees, failure modes, APIs (or lack thereof).

And as choices increased, coordination became harder, reliability decreased.

Standardizing intent, not execution

Today, making a traditional payment feels seamless. You can pay for goods/services online in seconds, transfer to friends and families, heck even move money across borders (albeit not entirely frictionlessly) but still better than in the past.

The breakthrough wasn’t fewer systems nor forcing all banking institutions onto the same rails, but rather agreeing on what a “payment request” actually means whilst allowing execution to remain heterogeneous. And so today with:

- SWIFT: Banks standardized instructions, not settlement.

- Mastercard/Visa: Merchants accept payments without caring which bank you used, which clearing system settled it, they care that payment worked.

This distinction – standardizing intent while abstracting execution is what allowed financial systems to scale.

Why Crypto hasn’t crossed this bridge yet

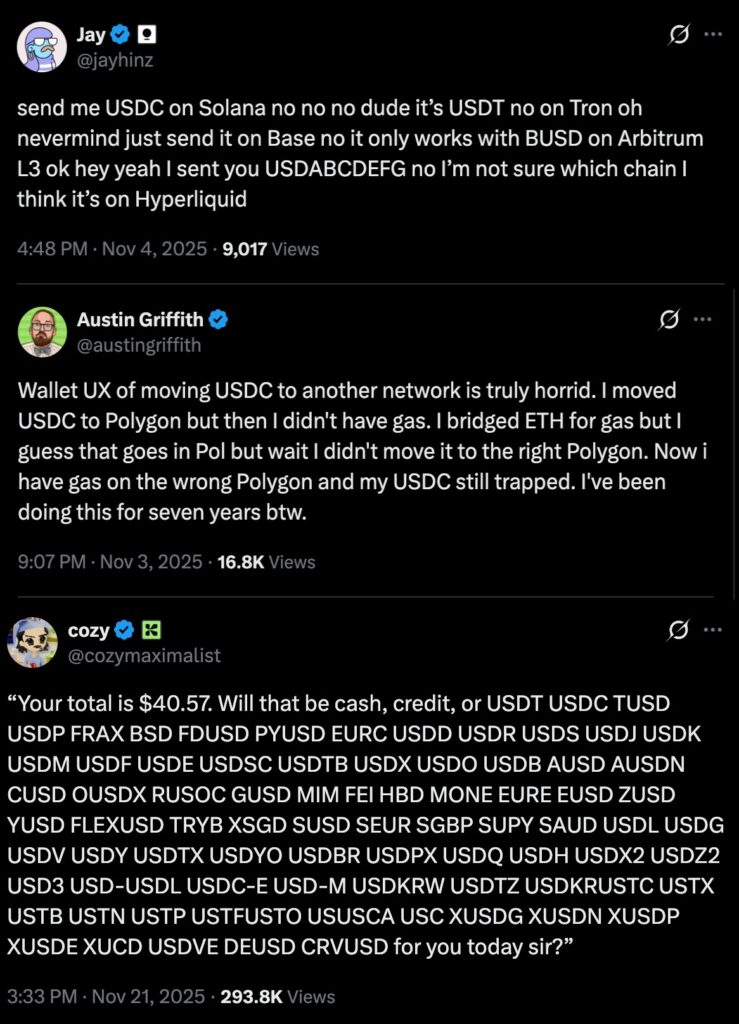

The screenshots above summarizes the problem with the UX in crypto today. Navigating a multichain, multi-token ecosystem has proven to be daunting. Even worse for developers who have to manage infra across multiple chains just to access more users and liquidity.

As with traditional finance, the solution to this is not forcing the use of a particular L1, L2, bridge, etc but rather building better abstractions over these to ensure users never have to bother about them.

Users’ real questions are never “which app/bridge/chain/L2 should I use?” but rather “given this outcome I want, what’s the fastest, cheapest and safest way to get there?”

Chainrails – An attempt to unify a fragmented landscape

Today, value moves across chains primarily through bridges. They’ve been our first attempt at connecting a fragmented ecosystem — similar to early correspondent banking. But relying on bridges alone breaks down once applications enter the picture.

Applications are the real gatekeepers of blockchains today. A chain’s success depends less on its technical merits and more on the applications built on top of it.

Take Polymarket — one of the most successful consumer applications in Web3. At its peak during the U.S. elections, it reached hundreds of thousands of monthly active users, many of whom had never interacted with a wallet before.

Polymarket being built on Polygon, a user on Base/Arbitrum/Starknet/Avalanche/Solana would first have to bridge their funds before being able to carry out any actions on Polygon. App developers in a bid to reduce this friction, integrate the APIs from bridges directly into their applications, but this introduces a new set of problems:

- Users want to deposit from chains not supported by the chosen bridge.

- Supporting multiple bridges means juggling different APIs, guarantees, and failure modes..

- Applications must monitor transactions for completion and refunds, accounting for bridge-specific nuances.

Each app ends up rebuilding the same fragile orchestration logic.

We built Chainrails to answer a simple question for both users and developers:

“Given this payment outcome I want, what’s the fastest, cheapest and safest way to achieve it?”

Chainrails is an abstraction layer that aggregates multiple bridging and ramping infrastructures, turning cross-chain payments into a single, reliably boring operation.

With Chainrails:

- Developers support multiple chains out of the box through simple APIs and SDKs.

- Users get predictable execution at the lowest possible cost.

- Developers no longer manage retries, refunds, liquidity risk, or route discovery.

- Applications become future-proof, supporting new chains without reintegration.

You can try the demo here.

Chainrails was built from firsthand experience, after building consumer applications and repeatedly running into the same infrastructure walls. It’s the system we wish existed, and we’d love feedback on how it can be improved.

Concluding Thoughts

Multi-chain isn’t broken.

But until we stop asking applications to orchestrate it, it will remain unusable at scale.